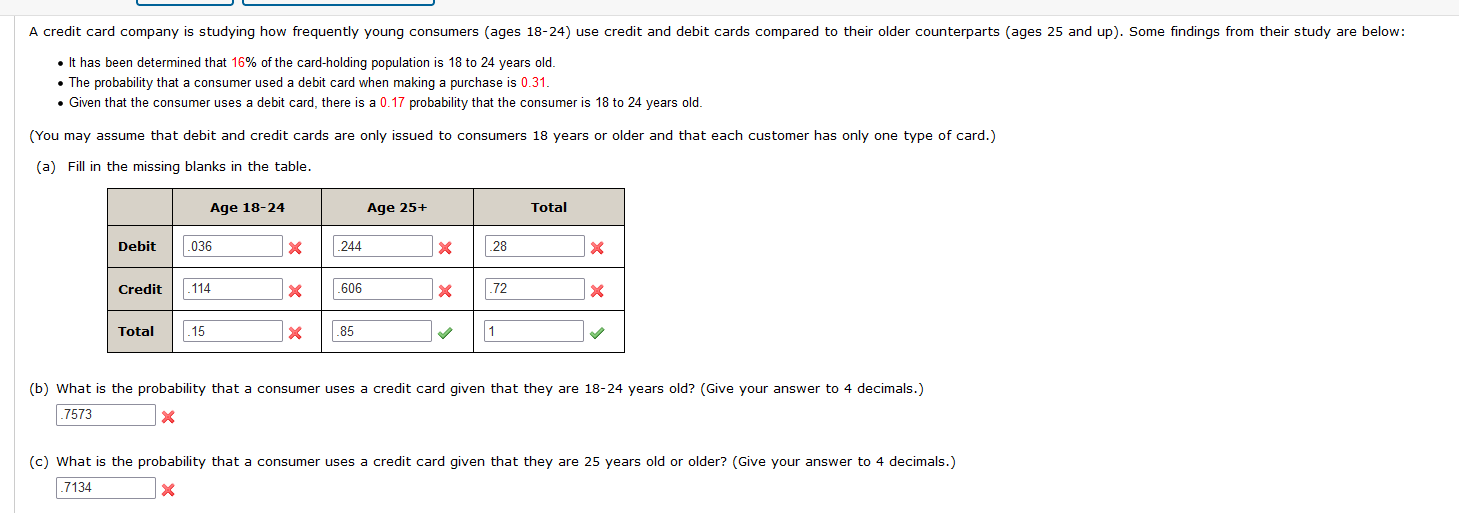

Are you wondering "How can I improve credit score?" then you've come to the right place. There are simple steps you could take to improve the credit score. These include requesting a copy, rectifying errors in your report and paying off credit card debt.

Get a copy to your credit report

One of the most important steps to improving your credit score is to obtain a copy of credit reports. It can also help you avoid making mistakes that could hurt your score. For instance, you can try disputing inaccurate information with the credit bureaus. If bureaus are willing, they will remove the inaccurate information from the credit report within 30 working days. You can also improve your credit score by paying on time for your existing accounts.

You can obtain a free credit report online or by post within one day. Keep in mind that credit agencies keep different information. Therefore, you might have more than 1 report. A free credit score can be requested from any number of agencies. However, not every agency will provide the same score.

Renewing your credit card

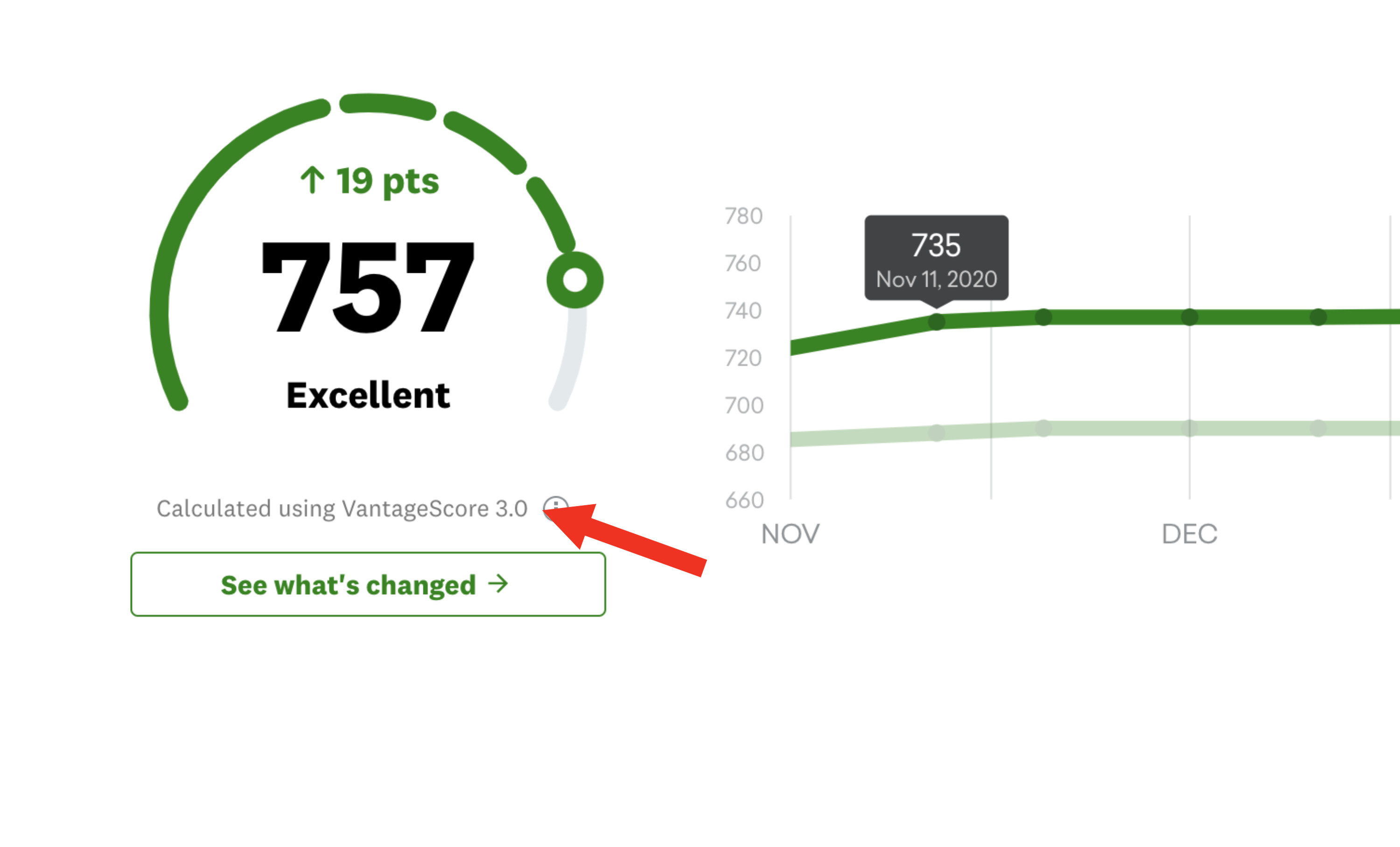

Getting a new credit card can improve your credit score, but be aware that it can also damage it. Pay your bills on time, and avoid high balances. Credit scores are determined by many factors. The most important one is your payment history. Credit scores that are high can help you qualify for top credit cards.

The credit utilization ratio (or the ratio between credit balances and available credit) is one of the most important factors that affect your credit score. Maintaining a low credit utilization rate is crucial as it shows your ability to manage your credit. You should keep your total debts to 30% of your credit cards. The ability to keep small balances from old cards can help you build credit. You can also make automatic payments to these cards.

Repaying credit card debt

It is a great way of improving your credit score by paying off credit card debt. You will see an even greater impact if you have bad credit. Your credit score can go up by as much 40 points if all of your debts are paid each month. Paying down your debt will allow you to obtain prime lending options with the highest interest rates.

A high-limit card with a high limit can be paid off to increase your credit score. Paying off a card with a high limit can improve your credit score because it will lower the amount of debt you have. If you pay $500 off a $1,000 card limit, your total debt will drop from $1,500 down to $700. This will also lower your credit utilization ratio, which will be a positive for your credit score.

Correcting credit reporting errors

There are several ways to correct errors on your credit report. Contacting the credit bureaus directly is one option. You can file a dispute online or by mail. Credit bureaus will review your dispute. Once they have reviewed your dispute they will contact your to discuss your case.

There is no cost to correct errors. It is vital to report any errors that you are aware of and make a formal dispute. Your credit score will increase if you do this. Although most of these errors will not cause any damage, 25% could result in denial of credit and additional costs. Fortunately, you can dispute these errors through the Fair Credit Reporting Act, which requires credit reporting agencies to fix errors within 30 days.

Requesting a credit limit increase

If you're thinking about asking for an increase on your credit card, you need to understand how the process works and how to make the request in the best possible way. First, contact your credit card provider directly. You can do this by calling them on the phone or filling out the online application. You should be able and able to understand the process. It is important to be calm and professional while making your request.

You must also prove that you are responsible cardholder. This means that you are responsible cardholder and make payments on time. Also, it is important to make additional monthly payments on your account. The issuer may increase your credit limit if you have a good track record.