When looking at your credit report, you may notice a large difference in your score. It doesn't always mean you are in financial distress, or that you're displaying bad behavior. There are a few possible reasons that your score might be higher than it should. The majority of cases have their roots in errors and/or reporting differences. Any errors can be fixed by working directly with either the creditor, or the credit bureau.

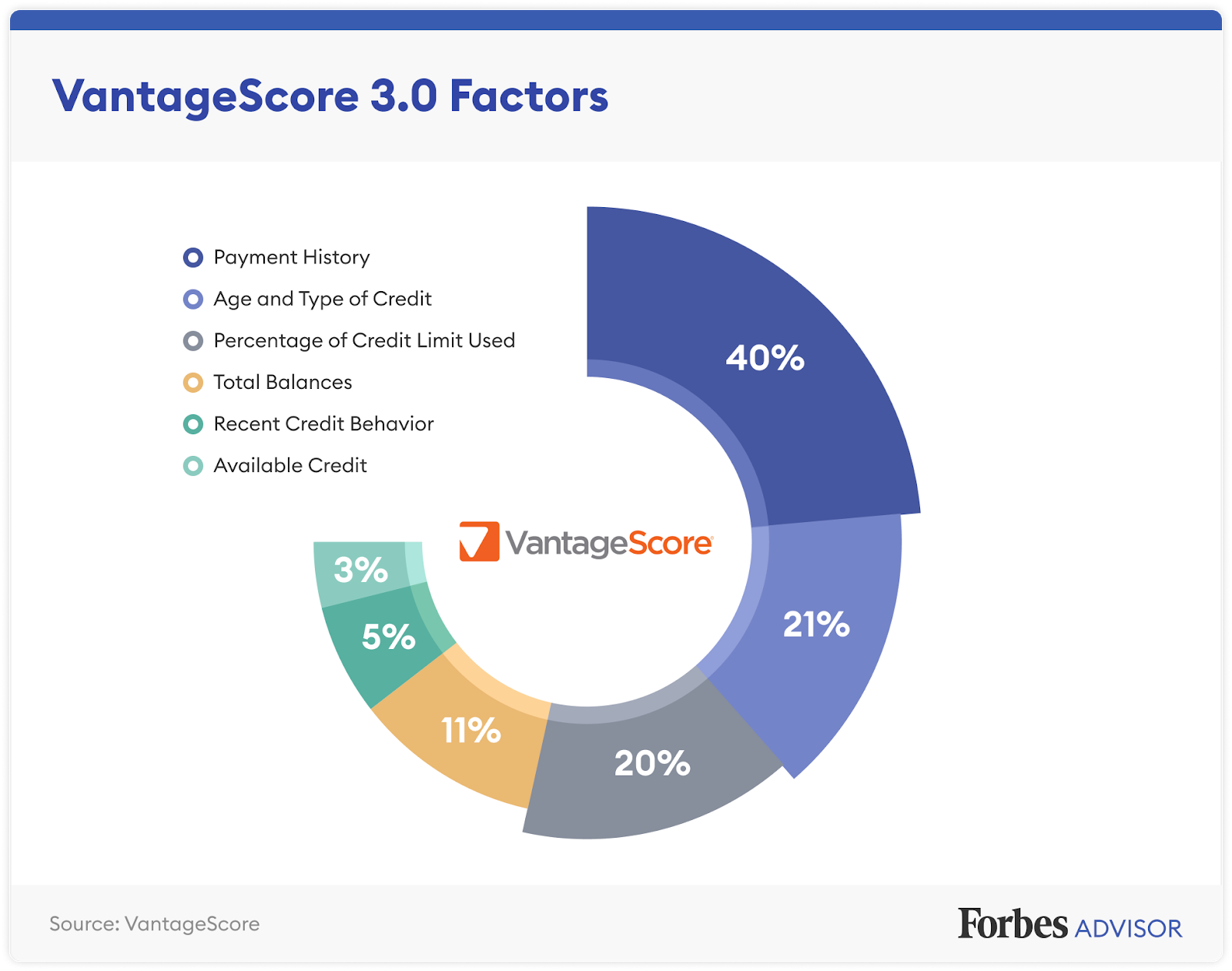

Different credit reporting agencies use different scoring models. Each one weighs information differently. FICO is the most popular scoring model. VantageScore uses more data in order to calculate a score.

A Consumer Financial Protection Bureau new study found that consumers may receive drastically different scores from their creditors. This is largely due to the fact that some companies do not report to all three of the nation's main credit reporting agencies (CRAs) at once. That's because CRAs use different scoring models and rely on different types of financial data.

A study by the Dodd-Frank Act prompted the Consumer Financial Protection Bureau to perform a number of studies that explored the various differences between credit scores and other similar functions. The results of these studies were very informative, even though they were not intended to reveal whether credit rating agencies intentionally try to fool consumers by using their scoring systems.

FICO is the most basic credit scoring system. This is the score that you most likely will see in credit reports. The score represents your credit history, usage, or other information that helps lenders assess whether you are a high-risk borrower. Creditors view the score as a measure of your risk of not paying off your debt, and this score will vary from bureau to bureau.

VantageScore is a similar scoring system. It focuses on the amount of your credit card and loan payments over time. The scoring model takes into consideration a variety factors such as length of credit history and recent payments. It also considers the types of debt that you currently have.

There are some interesting differences between urban and rural consumers in credit scores. While both groups have the same basic credit rating system, the average credit score is considerably lower in the former. These scores can also be affected by the economy and local population. Urban areas are generally more financially secure, and those living in metropolitan areas tend to have more favorable credit behaviors.

One of the most obvious ways to get a better score is to make sure your reporting is consistent. Contact your creditor to verify that your credit limit was reported to all three credit agencies. The credit bureaus should be able and willing to correct the mistake, although it may take some time.

There are other factors that can affect your score, including a credit card account that is not reported to the credit bureaus. You should check your credit report for errors, such as past names, loan amounts, and credit cards in your name.