Credit monitoring companies can monitor your credit and alert you when there are any changes. They can also assist you in removing outdated information and improving your credit score. These services are beneficial because they can protect your identity, and minimize damage caused by identity theft. They can also help you identify fraudulent activity early so that your credit doesn't suffer further. In addition to this, these services protect your credit on multiple devices, including mobile devices.

TransUnion

If you want to protect your personal financial information, a TransUnion credit monitoring service is an excellent choice. This service gives you unlimited access to your credit score and will notify you if your credit has experienced any significant changes. This is an especially valuable tool for preventing identity fraud, because you can take immediate action to stop someone else from stealing your identity.

TransUnion credit monitoring service can alert to any changes in you credit score or payment profile. You will also be notified if your credit is being misused. These services are also very affordable, with monthly subscriptions as low as $7.95. For this low price, you'll be able to check your credit report as often as you want. TransUnion credit monitoring services monitor your credit reports continuously and send alerts when changes occur, as well as when new negative information is reported.

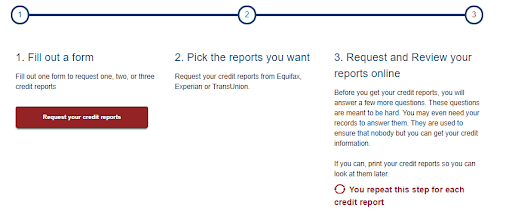

Once you have chosen a monitoring agency, you will be able to start monitoring your credit score immediately. To start, you'll need to enter your Social Security number, date of birth, and addresses of previous residences. After that you'll have access to your private account. You can view your credit report and answer security questions. You can also set up online credit locks to protect your identity in case of identity theft.

Experian

Experian is among the three major credit agencies and offers competitively-priced triple-bureau credit reports and credit surveillance. Experian offers a free credit monitor service. They also offer paid services such as identity theft monitoring and dark web surveillance. Experian offers a mobile App that users can use to monitor their credit report.

CreditWorks, a credit monitoring service offered by Experian for free, gives consumers free access to their credit reports and FICO scores. Subscriptions can also be purchased and provide additional services that are very affordable. CreditWorks has several subscription options that can help you monitor your credit score and improve it.

Experian has a strong support team to assist customers with any credit-related questions. You can contact an agent to resolve identity theft fraud if you suspect that your identity has been stolen. Experian offers a powerful dashboard that lets you access your reports from any device.

Equifax

Equifax offers several credit monitoring plans. One plan can cover all three bureaus. Another option is to pay a monthly charge to receive your scores each day. This service is particularly useful if you're looking to protect yourself from identity theft, as watching your credit report for unexpected changes is one of the best ways to detect fraud.

Equifax customer service can be reached via phone or online chat. The Equifax customer service team is available to you Monday through Friday between 6 a.m. and 8 p.m. Pacific Time (PT). They are also available weekends. The company also offers a chat portal online from 8 a.m. to midnight (ET). You can also contact the company to report a dispute with your credit or for general questions.

Equifax also offers a free credit locking service that provides additional protection against identity thieves. You can also get an automatic alert for fraud, which encourages lenders verifying your identity. Although these services do not provide complete protection, they can help you to protect yourself against identity theft. Experian, IdentityForce, and Experian offer more advanced monitoring options.