A balance transfer credit card is a great way to reduce your overall credit utilization. You will also be able to improve your credit score. Your new card will have a large balance at the time you transfer the balance. It will be crucial to pay it off as soon and as quickly as possible. If you're not sure you can repay the balance transfer credit card within a reasonable timeframe, you should avoid applying.

Positively

A balance transfer can have both positive or negative effects on your credit score. Positives include a lower average age for credit accounts and a reduction in debt. Paying off debt quickly and making timely payments will minimize the negatives. You can improve your credit score by using balance transfers without having to apply for new credit.

The negative effects of transferring a balanced are temporary. Although a balance transfer doesn't affect your total credit limit or individual card usage, it can have a temporary impact on your credit score. This may affect your credit score in the short term, but the interest savings and ability to pay off your debt faster should more than offset these short-term negatives. WalletHub provides a free credit score simulator that can help you determine if a balance transfer will have an impact on your score.

Negatively

Balance transfers can boost your credit score. However it is important to make sure you are using them correctly. You can damage your credit score by performing them on multiple credit cards at once or increasing your credit card usage. Before you make a balance transfer, be aware of the potential negative effects.

The positive impact of a balance transfer can be seen when you make timely payments. It increases your credit utilization ratio, and your credit-to debt ratio. The addition of a new creditcard will increase your total credit limit. Lenders do not like credit utilization rates of 30% or more.

Check your credit report before applying for a balance transfer card

Credit cards for balance transfer require that you have excellent or good credit. However, there are some credit cards that will allow balance transfers for those with fair credit. Balance transfers may not be possible with the same bank that you transferred the balance from. Some credit card companies will let you transfer your balance to another card.

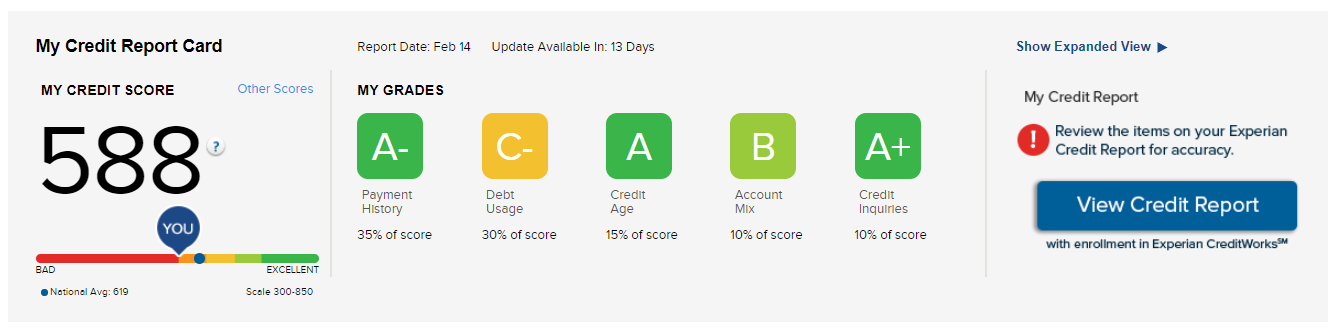

Credit Karma is a service that allows you to check your credit reports for free. To find the best balance transfer credit card, you can also use credit score tool. These tools will show you which cards offer the best introductory rates of 0%. You can also compare rewards programs and additional benefits.

Plan repayments over a reduced-interest period

You might want to think about a repayment strategy if you have too much creditcard debt and are struggling with your monthly payments. This will reduce your monthly costs and increase your credit score. Credit utilization is also known by the "amounts due" category of your credit report. The goal is to reduce your balances to no more than 30% of your total available credit.

Credit score impact of hard inquiries

Hard inquiries are recorded on your credit report and can have a negative impact on your score. These are typically the result of an application for credit, such as a car loan or student loan. Although these inquiries won't affect your credit score directly they can be seen on your credit report for as long as two years. Landlords can also request hard inquiries as part of an application for apartments. While landlords are not required to do so, FICO counts these checks as hard inquiries.

The elements in your credit reports can impact your credit score, which could result in a drop of five to ten percentage points. FICO estimates most consumers will not notice any significant impact. FICO believes that this temporary effect will diminish or disappear as your credit rating improves.