Credit scores can change from time to time. The frequency of these changes will vary depending on your financial situation. It is calculated from the information in your credit report, which should be updated when there is any change. You credit report includes information on your credit accounts, payment histories, total credit, and most recent requests.

Information reported to the credit bureaus

Credit bureaus often receive information from creditors, card issuers, or other companies. This can cause credit scores to change. These companies are legally required by law to provide the bureaus with accurate information within a given time. Each bureau then calculates your score based on the latest information.

You have the right to dispute any credit reporting error. The letter you send must contain a copy to the creditor indicating the dispute. The dispute process may take 30 to 90 days. Most states will provide a free copy to you of your credit reports once the dispute process has been completed.

Late payments

Late payments could be detrimental to your credit. While you may not be able to avoid late fees forever, there are ways to avoid them. To avoid them, pay your bills on schedule. The credit bureaus must be notified of late payments within 30 days. This gives you time to make up the missed payments. Late payments can increase your interest rates and decrease the credit limit.

Late payments will have a different effect on your score, depending on the length. Your score is likely to drop significantly if you are late for more days than if it was 30 days.

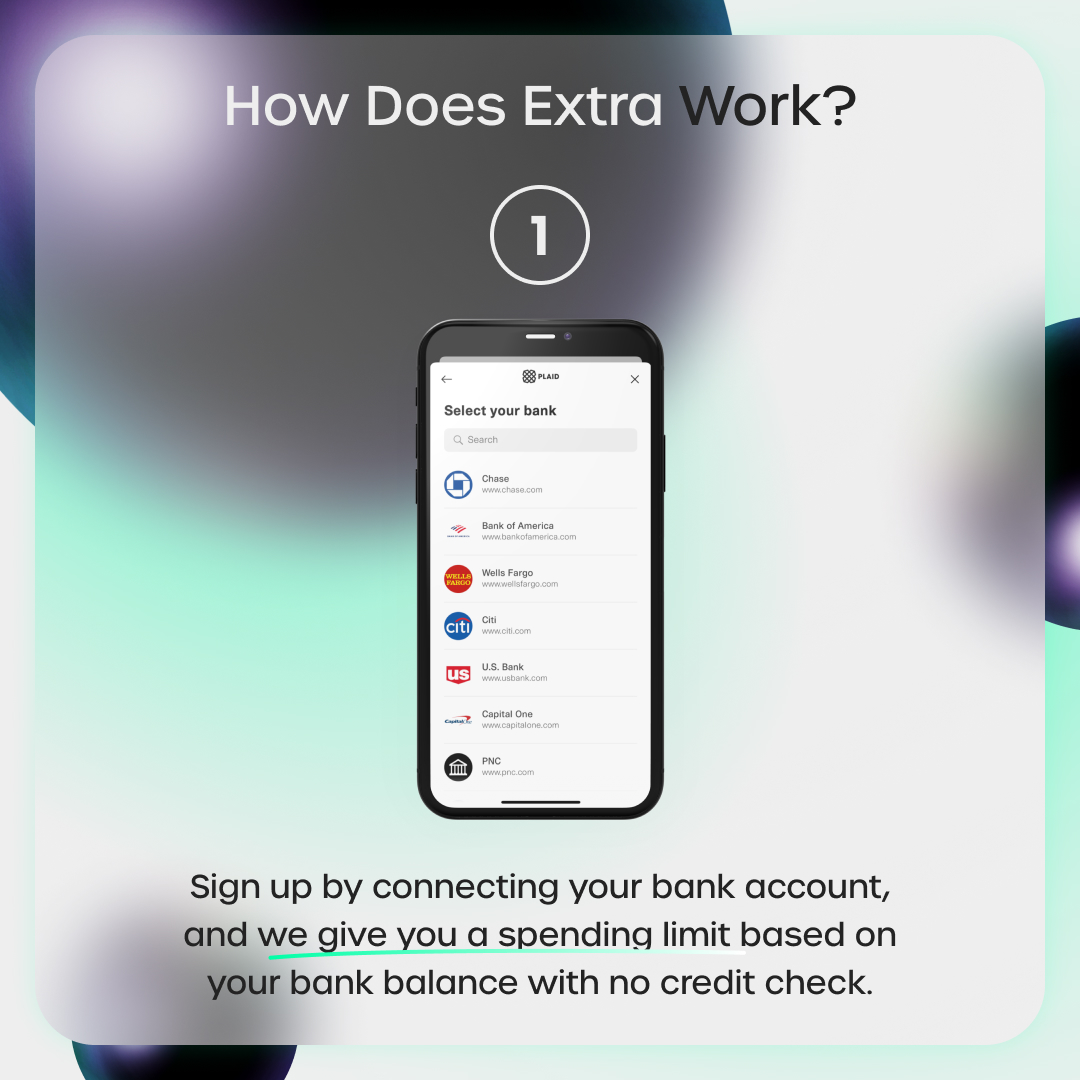

Hard inquiries

Your credit score may be affected by the number of hard inquiries. While the number of hard inquiries is not as important in calculating your credit score but they play an important role in assessing your likelihood of repaying your debts, When a lender pulls your report, they look for information like your income and payments history. If you have too many inquiries on your credit report, it could indicate financial stress and increase your risk of defaulting on your loans.

A single inquiry can drop your credit score up to five points. Two or more hard inquiries can reduce your credit score by 10 points. Additionally, those with six or fewer recent hard inquiries are eight to one more likely that they will file for bankruptcy. The good news is most people don’t have to make as many inquiries as necessary to have negative effects on their credit scores.

Lenders are required to report account information and payment information.

Credit scores are updated each month when credit bureaus receive new information from creditors. But, not all lenders report information the same way. This means that if you pay off a debt, it may not appear on your credit report immediately. In this case, it can take 30 to 60 days before your payment is reflected on your credit report.

Lenders send account and payment information to the credit agencies at least once each month. However, this may vary. Lenders report to only one or two bureaus monthly, while others report to all three. However, most lenders report account details and payment information monthly to the major bureaus of credit.