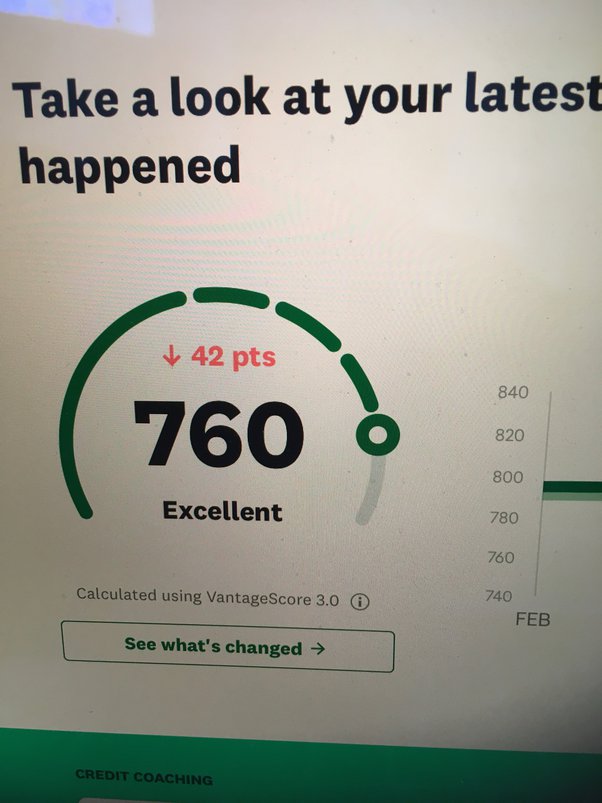

Start building credit as soon as you can, even if your college degree is not yet completed. Early credit building will give you the opportunity to achieve your financial goals, including being able to obtain financial products at lower interest rates. Here are some tips: Keep your payments on schedule; keep your accounts small; avoid spending above the limit.

Making timely payments

Being punctual with your payments can help you build a payment history that will be useful for when you graduate. Paying your credit card on time is important as late payments can affect your credit score. Even if that means paying a lower amount than you should, make sure you keep up with your credit card payments.

It takes time to build credit during college. However, opportunities do exist, even if they come with limitations. While you are still a student, you can build your credit history by making timely payments and understanding FICO(r).

Avoid high interest rate

It is important to avoid high interest rates for student loans. Unlike a traditional loan, which has a variable interest rate, federal loans have fixed rates that are set by Congress. They are currently higher than in 2016, but lower than they were during 2014. While high interest rates aren't unavoidable, you should avoid them whenever you can. Even if the loan is not paid off immediately, interest rates can add up to thousands of Dollars over the loan's life.

A direct payment to your college is another way to avoid high interest rate. Many colleges offer low-cost and interest-free payment plans. It's more efficient to pay in monthly installments than to pay one lump sum. Friends and family may be able help you. Crowdfunding, although relatively new in the student debt arena, is quickly gaining popularity.

Avoid spending close to the upper limit

A college student's best chance to build credit is to be able to match your spending with your income. You don't want to accumulate a large amount of debt on your card. This will only lead to higher interest rates and a decrease in your credit score. Credit limit will affect how credit score.

Credit cards are crucial for college students. You must use them carefully and make sure you pay them off each month. The first time that a young person is able to make financial decisions for himself or herself is in college. It is easy to fall behind in your payments by carrying a large unpaid balance. Set limits for your credit cards and plan ahead how you will pay the bill each month.