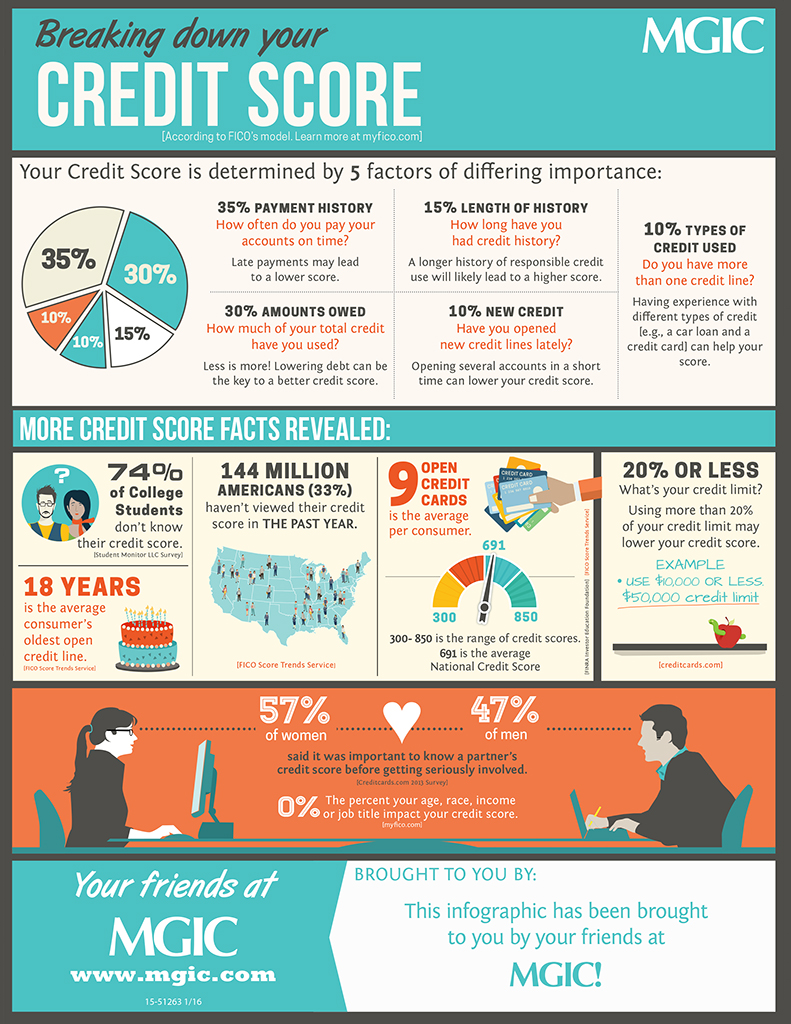

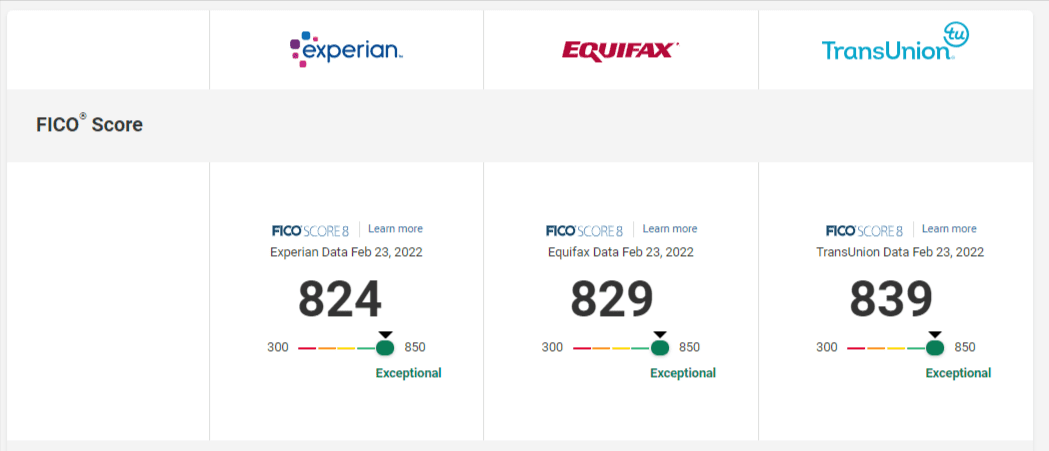

FICO Score helps lenders make better financial decisions about you and your loan applications. It measures your payment history. Credit history length and credit usage. FICO Scores can be calculated from information in your credit report. However, it is possible to have a positive effect on your FICO score by paying your bills on-time and avoiding too many debts.

Payment history

Your credit score will improve if you pay your bills on schedule. A budget is a way to do this. While you may have to give up some things in order to do this, it is important to make sure you pay your bills on time. If you're still struggling to make ends meet, you can use a credit card to pay your bills.

Credit history length

Credit score is affected by your credit history. It is calculated by averaging the age of all your accounts and the date you last used them. Closed "good standing", accounts won't show up in credit scores for approximately 10 years.

New credit

Your credit score is affected by many factors, including how many credit accounts you have. The length of credit history affects 15% of your score. Your overall score will also be affected if you have more than 10% new credit. This number includes both the number and type of new accounts that you have opened, as well as the number of hard inquiries that you have made in recent months.

New credit accounts

The potential impact of opening a new credit card account on your FICO score is significant. It can negatively impact your score if you have a history of late payments, and opening multiple accounts may indicate that you need lots of credit. The factors that affect your credit score include how frequently you pay and how much credit you have. Your first account can help you build a solid credit score if you make responsible use of it.

The history of renting

Your rental history plays a critical role in your credit report. This information can also be helpful in building your credit score. This information is used by lenders to calculate your Fico score. There are many options to report your rental history. A rent reporting service is one way to report your rental history. These services will send your rental payments to the credit reporting agencies for you. This is an excellent way to establish your credit history and avoid late fees or interest rates.

Credit mix

Fico score is a number calculated based on credit mix and credit utilization. Although your credit mix is the key determinant for your credit score (and the largest factor), there are other factors that can impact your score such as your payment history, credit utilization ratio, and payment history. These factors can be improved in order to improve your overall credit score.