The Capital One Platinum creditcard is one of best options to build and maintain good credit scores. It's a solid option because there is no annual fee and there is no foreign transaction fee.

However, the Capital One Platinum cards has an interest rates that is higher than average. The card is not suitable for those who have a tight budget or need to reduce their debt. Capital One Secured Mastercard is a better option. It is free of annual fees and comes with a refundable security bond.

The Capital One Platinum card doesn't offer rewards but it does have some features that could benefit your credit. You'll be able to access the Capital One CreditWise credit-building tools. Access to educational content, as well as a free credit score, will be available.

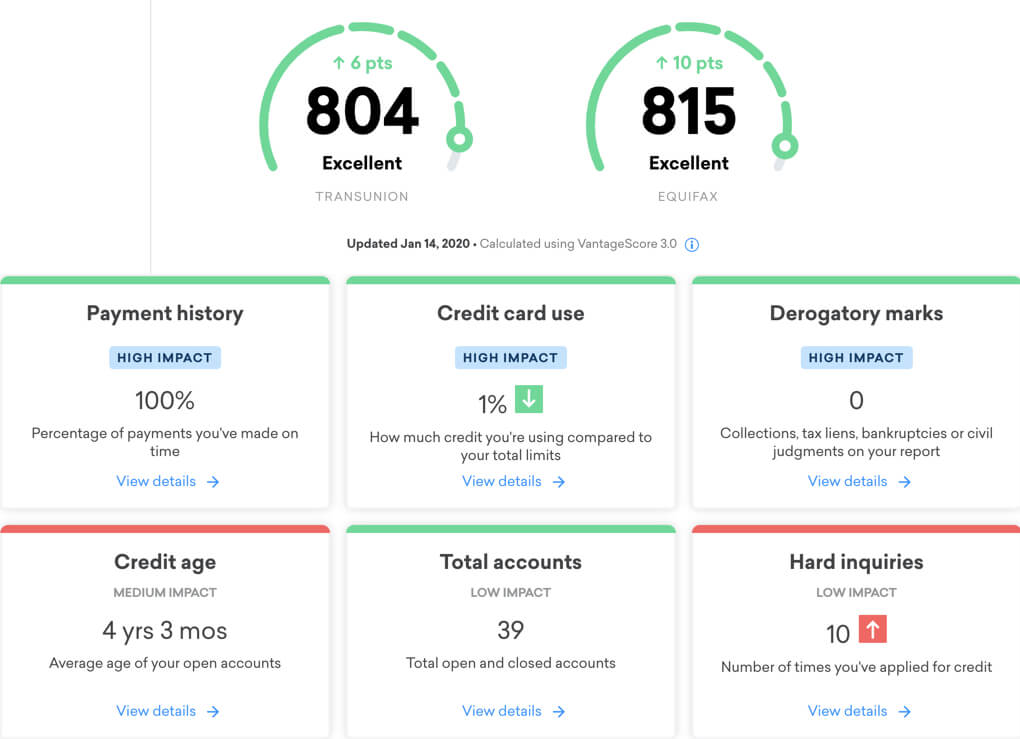

You can either pay your bill online or in person at a local branch. TransUnion, Equifax, Experian and TransUnion will receive reports on your payments. By maintaining your balance and making payments on time, you'll improve your credit score. By continuing to use Capital One Platinum credit, you can increase both your credit line as well as your credit utilization.

Additionally, the Capital One Platinum card has some cool travel perks. There are no foreign transaction fees and you can use your card for travel outside the U.S.

In addition to these features, the Capital One Platinum Card has an automatic credit line increase after six months. Based on your credit history, you will receive a new credit limit once you are approved.

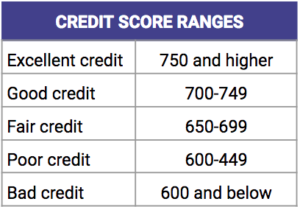

You will need to complete an application when applying for Capital One Platinum cards. Your eligibility is determined by your credit score and income. Typically, applicants with a FICO score of at least 580 can be approved for a card. Keep in mind, however, that not all companies follow the same guidelines. You may not be approved if you have a history delinquent.

Another advantage of the Capital One Platinum card is that it has a lower than average credit utilization rate. A great way to improve your credit score is to lower your credit utilization rate. The Capital One Platinum is a great way to build credit history, even if you aren't eligible for a card.

Despite its high interest rate, the Capital One Platinum Credit Card is a worthwhile option for those with average or fair credit. The card doesn't require any upfront deposit and is therefore a good choice for anyone just beginning to build their credit.

Capital One Spark Miles Select is one of the other cards that you should consider. These cards give you the opportunity to redeem reward points for Amazon purchases and earn cash back.

Additional features to be aware of when applying for Capital One cards are the low annual fee, security alerts, as well as fraud liability. The Capital One Platinum card is not for everyone. However, anyone needing a little assistance rebuilding their credit may find it useful.