OpenSky Secured Visa Credit Card with No Security Deposit is an option for those looking for a second credit card. It is a unique product that offers flexible payment options, without the need to deposit. In contrast, credit cards with collateral require a deposit.

OpenSky Secured Visa Card(r)

OpenSky Secured Visar credit cards are an option for consumers with bad credit and no bank account. OpenSky is open to all credit types. It will report your monthly expenses and minimum payments, which can help you build credit.

Although the OpenSky Secured Visa Credit Card does not offer a rewards program, it does offer some benefits. For example, you'll have access to roadside assistance and $0 liability for fraud, and it also offers auto rental insurance. The $35 annual fee for the OpenSky Secured Visa is however a concern. This makes it less attractive to consumers with excellent credit.

Indigo

Applying for a second chance creditcard can help you rebuild your credit score if you have bad credit. Indigo accepts applications from applicants who have been rejected elsewhere. Prequalification can be achieved without having to lower your credit score. It can also give you an idea about your chances of getting approved. The card should not be considered a permanent solution. Second chance credit card are usually expensive and offer very limited benefits.

A second chance credit card from Indigo with no security deposit is for those with less than perfect credit. The card won't affect your credit score, so it will help you rebuild your credit while allowing you to make purchases when you want. The only problem with this card is the lack of a rewards or signup bonus. If you are looking for a creditcard without a security deposit the Indigo Mastercard might be the right choice. You won't pay any cash advance fees for the first year, and you can use the card to make purchases in any store or online.

Get Credit

The Grow Credit Mastercard is a great way to improve your credit score, even if you have poor credit or no credit history. By qualifying monthly subscriptions to streaming services and paying bills, you can improve your credit score. The card works similarly to a creditcard with a limited credit line and all payments are reported directly to all three major credit reporting agencies.

Although second chance credit cards are great for people with bad credit, it's important to look for a card with reasonable terms and conditions. Some cards require an annual fee, or a security deposit. Others may have high interest rates and restrictions about where they can be used. It's difficult to use a card regularly if the terms are not reasonable. It is important to find a card offering rewards and easy use.

Tomo

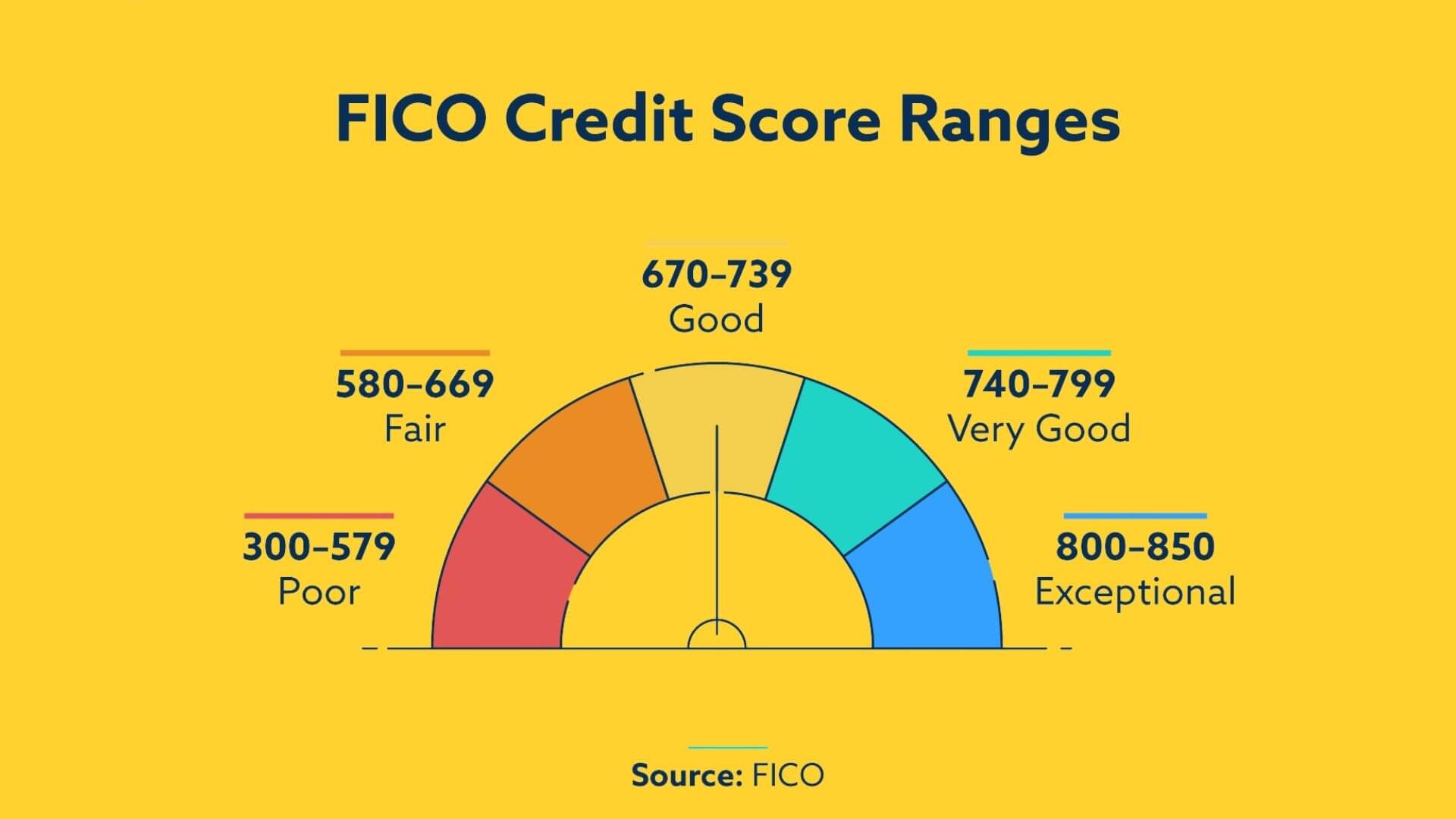

You may wonder if a second chance card is right for your bad credit. These credit cards are not subject to a security fee. You can apply online for a credit card and receive an approval within minutes. A number of other benefits are also offered, including 24/7 access to your FICO(r), score, and free credit reports for all three major bureaus. Additionally, there is no membership fee. The application process is simple, and there's no security deposit, so there's no need to worry.

Tomo's unique underwriting system takes into consideration all financial data including bank account balances, investment performance, and how you manage your money. It is easier to be approved for higher credit limits if your financial history is stronger. Tomo will not require a security deposit. However, you will need basic information to be pre-approved.

Total Visa(r).

Total Visa(r), Second Chance Credit Card may be a good choice for you if you have low or no credit. Apply online and you will receive a response within minutes. Once approved, you will get an unsecured Visa cards that you can use everyday. You can use the card at any merchant in the US, and you can pick the design. Reliable use of your card can help you improve your credit score.

The Total Visa(r) Card is not for everyone. This card does not require a security fee, but the annual and monthly fees are expensive. To open an account, you'll need to pay an initial $89 registration fee. The first year, there is an additional $75 annual fee. After that, you'll pay a combined $123 in monthly and annual fees.