There are many options to choose between if you want a secured credit card that has flexible terms and offers higher cash back rates. These cards have a lot of flexibility and are not subject to credit checks. Approval should be granted as long you can afford the security fee. However, these types of cards often come with high annual fees and APRs, and there is no clear path to unsecured status.

Capital One Quicksilver Secured cash Rewards Credit Card

The Capital One Quicksilver Secured Cash Reward Credit Card is a great option for people who have poor credit. The $200 deposit is all that is required to open the Capital One Quicksilver Secured Cash Reward Credit Card. Within six months, applicants will be granted a greater credit limit. Capital One will raise the credit limit automatically after six months of timely payments. The card has a low annual fee, a low interest-rate, and carries a small minimum balance.

Capital One Quicksilver Secured Money Reward Credit Cards has another amazing feature: its rewards program. The rewards program offers unlimited 1.5% cashback and 5% cashback for purchases made at Capital One Travel. This unique feature makes Capital One Quicksilver Secured cash Rewards Credit Card the best among secured credit card. The card offers more than just earning points. It also has other benefits such as zero fraud liability and a monthly FICO credit score of zero.

Discover it Secured

The Discover it Secured credit card is a great choice for people who are looking for a secured credit card with a generous welcome offer. The first year of card use offers 2% cash back at gas stations and restaurants and unlimited 1% cash back on all other purchases. It also offers a cash back match program, meaning that the first year of rewards will be matched by Discover. You can earn cash back immediately and still establish credit.

Discover it Secured card is a credit card that offers great rewards. Cardholders can easily earn rewards by spending money on specific categories. These bonus categories were designed to match consumers' natural spending habits. This card offers cashback rewards that can be used at any time.

Capital One Platinum Secured Kreditkarte

Capital One Platinum Secured Credit Card has many benefits for those who have difficulty getting approved for traditional credit cards. For starters, this card has no annual fee and no foreign transaction fees. There are also no fees associated with late or returned payments. It can be used both online and in store for purchase.

The Platinum Secured Credit Card caters to those with very poor credit. It can provide a credit line of up $1,000. It comes with high-quality digital financial tools that will allow you to view your credit history anytime. It also provides practical benefits like Apple Pay support and travel assistance.

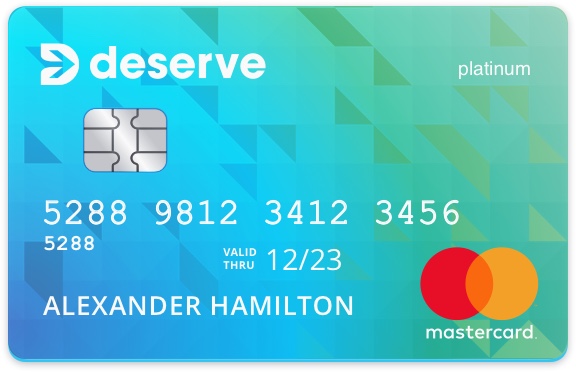

Capital One Secured Mastercard

The Capital One Secured Mastercard can be a great choice for those with poor credit or who are trying to rebuild their credit. The card features a zero-fee annual fee and a $200 credit limit. Although it is not a card that can be used for cash advances, the card can still be used to make purchases or build credit.

After you have made five timely payments, your Capital One Secured Mastercard credit limit can be increased. You must pay a $49 security deposit in order to receive your card. The credit line can be increased up to $1,000 if you make five on-time monthly payments.